How can you properly compensate service staff? What are the rules you need to follow? And how can you avoid costly mistakes? Managing working hours can quickly become a real headache for your HR team.

Between part-time contracts, complementary hours, and the many rules around pay increases, it’s easy to lose track. And above all, mistakes should be avoided at all costs! Poor management of working hours can lead to conflicts with your teams and legal repercussions. In this article, find out everything you need to know about complementary hours and how to manage this aspect of payroll as an employer.

Overtime hours and complementary hours: what’s the difference?

Between overtime and complementary hours, it’s not always easy to tell the difference. Yet, these concepts are an essential part of managing working time and employee compensation. While the terms may seem similar, they actually refer to very different situations, depending in particular on the type of employment contract and the collective agreements applicable to the employee’s role.

Permanent contract, fixed-term contract, full-time, part-time, collective bargaining agreement… all these HR elements can become tangled, and it’s easy to get confused! To avoid payroll errors, disputes, or misunderstandings, it’s crucial to understand the differences between these types of hours:

Overtime hours: These apply exclusively to full-time employees and refer to hours worked beyond the legal weekly working time, which is generally set at 35 hours in France. These hours are subject to increased pay based on the employee’s normal hourly rate (monthly gross salary / number of legal working hours in the month). For the first eight overtime hours, from the 36th to the 43rd hour, the employee receives a 25% pay increase, and a 50% increase applies beyond that. However, collective agreements may set different rates, but they can never be lower than 10%.

Complementary hours: These apply to part-time employees. Based on the same principle, they refer to hours worked beyond the number of hours specified in the employment contract. But be careful! Adding complementary hours must never bring the total working time up to the legal 35-hour weekly limit. In fact, a part-time employee cannot, even with complementary hours, reach the legal full-time working duration. Complementary hours are also subject to increased pay.

How are complementary hours paid?

The payment of complementary hours depends on several factors, including the number of hours worked and compliance with legal thresholds. In general, complementary hours are paid at the employee’s regular hourly rate, with specific and mandatory surcharges established by the 2013 Employment Security Act:

A 10% pay increase for each complementary hour worked up to one-tenth of the weekly or monthly working time specified in the employment contract.

A 25% pay increase for each hour worked beyond that one-tenth, within the authorized one-third limit.

Since January 2022, employees are exempt from income tax on complementary hours as long as the total does not exceed €7,500 per year. Beyond that threshold, these hours are subject to income tax and are either withheld at source or charged during the employee’s annual tax assessment.

Complementary hours are generally paid at the same time as regular working hours, that is, during the payroll period defined by the company. This period may vary depending on the company’s payroll cycle. As a general rule, complementary hours worked during a given month are paid with the following month’s salary. Just like base pay, payment must be made by the date specified in the employment contract or according to company policy and this delay cannot exceed one month.

How to automate the calculation of complementary hours?

Complementary hours: what are the rules for employers?

As an employer, you are required to comply with certain legal rules governing the execution and payment of complementary hours. These regulatory provisions ensure both your compliance and the security of your employees.

- Limits of complementary hours: Complementary hours are limited to 10% of the number of hours specified in the initial employment contract. For example, if an employee is contracted to work 20 hours per week, they can perform up to 2 complementary hours (i.e., 10% of 20 hours).

- Employee agreement: Complementary hours cannot be contested if the employer informs the employee of their execution at least 3 days before the scheduled date. Otherwise, these hours must be carried out with the prior consent of the employee. The employee has the right to refuse complementary hours if the 3-day notice period is exceeded or if the hours to be worked will exceed the maximum working hours specified in their contract.

In case of refusal by the employee, the employer may consider this opposition as misconduct, leading to suspension or dismissal. To avoid any issues, it is recommended to establish and include clear rules regarding complementary hours in your employees’ contracts.

Mandatory mention in the contract: The part-time employment contract must specify the possibility for the employee to perform complementary hours. According to Article L3123-9 of the French Labor Code, “The part-time employee’s contract is a written contract. It must notably mention: […] The limits within which complementary hours may be carried out.”

The contract must therefore mention the possibility of using complementary hours, the maximum number of hours that can be worked according to the legal working time, and the applicable pay increase rate if it differs from the legal minimum. If this mention is not included, you risk legal action and social disputes. This formalization helps clarify the working conditions for both parties and avoid misunderstandings.

Absolute limit: The total hours worked, including complementary hours, must not exceed the legal weekly working time of 35 hours. If this limit is exceeded, the employee can request a reclassification of their employment contract as full-time by the Labor Court. This limit is therefore a protective measure to prevent a part-time employee from working an excessive number of hours without a full-time contract and to avoid undeclared work.

What are the consequences of failing to comply with the rules for complementary hours?

If you do not comply with the rules regarding complementary hours, you risk several consequences, both legally and financially:

Requalification of the employment contract: When a part-time employee consistently works more complementary hours than those specified in their contract, they can take the matter to the Labor Court and request a reclassification of their contract to full-time. Indeed, the accumulation of complementary hours worked beyond the contractual time requires a modification of the employment contract. This reclassification entitles the employee to retroactive salary adjustments based on a full-time schedule, and sometimes compensation for damages if the employee is harmed.

Financial penalties: If the rules regarding compensation or complementary hours are not followed, the employer may be required to reimburse the employee for the amounts owed, in addition to the legal pay increases.

Furthermore, if the employer incorrectly reports or misreports these hours, they may be prosecuted for social fraud, with fines and financial penalties.

- Legal risks and disputes:

If an employee believes that their employer is not following the rules regarding complementary hours, they can take the matter to the appropriate court to claim the regularization of hours and their payment in accordance with the current legislation. If the employer fails to mention the possibility of complementary hours in the contract or imposes these hours without the employee’s consent, this could be seen as a violation of the employee’s fundamental rights and trigger legal action. - Urssaf audit: The employer may also face an audit by Urssaf if the rules regarding complementary hours and their payment are not respected. Urssaf can investigate the working conditions of employees and their compensation. Ultimately, this investigation could lead to recalculations of the social contributions owed and impose penalties for failing to meet legal obligations regarding compensation and social reporting.

- Reputation and relationships with employees: Finally, failing to adhere to the rules concerning complementary hours can damage the employer’s reputation, especially if employees feel that their rights are being violated. This can deteriorate the trust-based relationship between the employer and employees, lead to internal conflicts, increased turnover, and demotivation of teams.

Time tracking: a necessity for monitoring complementary hours

As an employer, you are legally required to maintain a strict record of your employees’ working hours. Far from being a mere formality, this obligation is a critical issue in terms of social compliance. To meet this requirement effectively, implementing time tracking systems is a highly valuable option. These tools allow you to accurately record clock-in and clock-out times, while automatically tracking complementary hours worked according to each contract. A precise monitoring of working hours and access to a history of entries/exits will help you demonstrate your compliance in case of an inspection by the labor authorities. Whether for the employer or for the employees, the benefits are mutual!

Time tracking tools

To track complementary hours, there are various technological solutions, ranging from basic to comprehensive. For secure traceability, forget about paper! Opt for digital tools that allow real-time data collection. Connected time tracking tools, such as badge readers, mobile apps, or time management software integrated with payroll systems, not only track hours worked precisely but also generate automatic alerts in case of overtime. Depending on the system, pay slips can even be automatically generated with the collected working hours.

Connected time clock: The connected time clock is a simple yet effective device that allows employees to clock in using a badge, chip, key fob, or personal code. This fixed equipment is ideal for large volumes of employees, particularly in industrial sites, warehouses, or multi-site companies. This system is typically paired with time management software, allowing for automatic data synchronization as soon as the employee clocks in or out of their work shift.

Mobile time tracking app: The mobile time tracking app is ideal for remote teams, multi-site employees, or workers who operate from different locations. With these apps, employees can clock in directly from their smartphones using localized QR Code technology or NFC Tags.

Clocking in via QR code: Clocking in via QR code is a modern and practical solution, especially in flexible or multi-site work environments. By scanning a unique QR code upon arrival or departure, employees quickly and contactlessly record their time on a dedicated form. No app is needed, just an internet connection!

MoveWORK Flow: the platform to manage complementary hours

In a context where labor time regulations are becoming increasingly demanding, managing complementary hours can no longer be done blindly. This is where a time management software becomes truly meaningful. Such a tool is a powerful lever for ensuring compliance and securing employer-employee relations.

ERP systems, industry-specific software, time tracking software… the list is long, but is it really worth it? Is simple centralization of work hours enough? Will you meet the legal and operational requirements related to complementary hours? In practice, these traditional tools quickly show their limitations: lack of responsiveness, fragmented data, no real-time alerts, and almost no analytics.

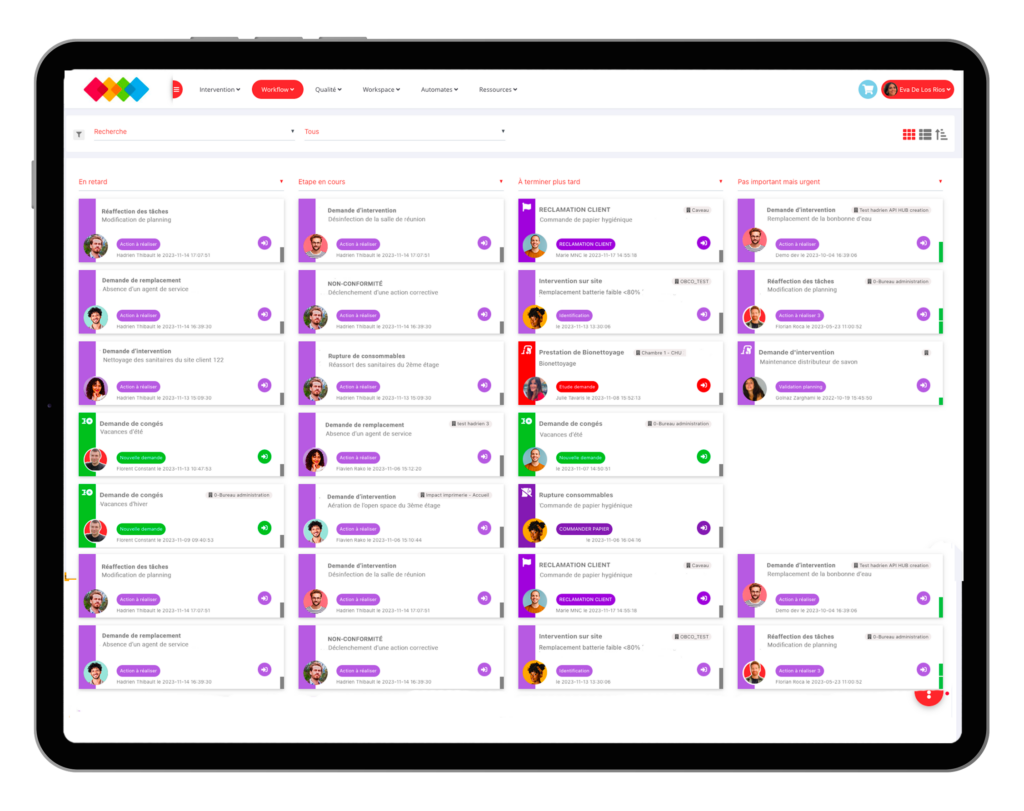

This is where MoveWORK Flow makes a difference. Specifically designed to streamline field team management, the platform allows you to plan, track, and analyze activities continuously, while ensuring complete traceability of working hours. With MoveWORK Flow, you stay fully aligned with the legislation while benefiting from a powerful tool to optimize your organization and enhance transparency in managing complementary hours.

You have complete visibility to ensure that legal thresholds are never exceeded. With automated alerts, you are immediately notified as soon as a complementary hours threshold is reached, allowing you to take quick action and adjust schedules with complete peace of mind.

Result: Smooth management of complementary hours and guaranteed compliance at all times!